下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Financial Statement Analysis5道练习题,附答案解析,供您备考练习。

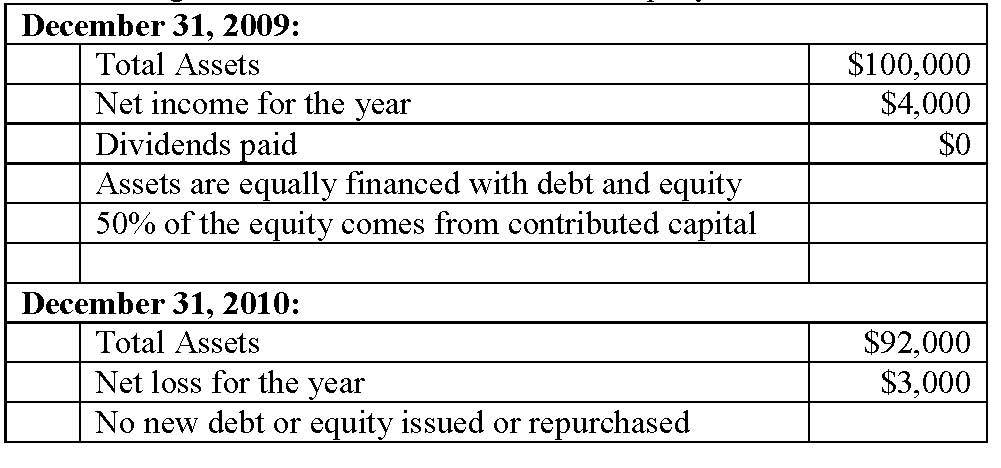

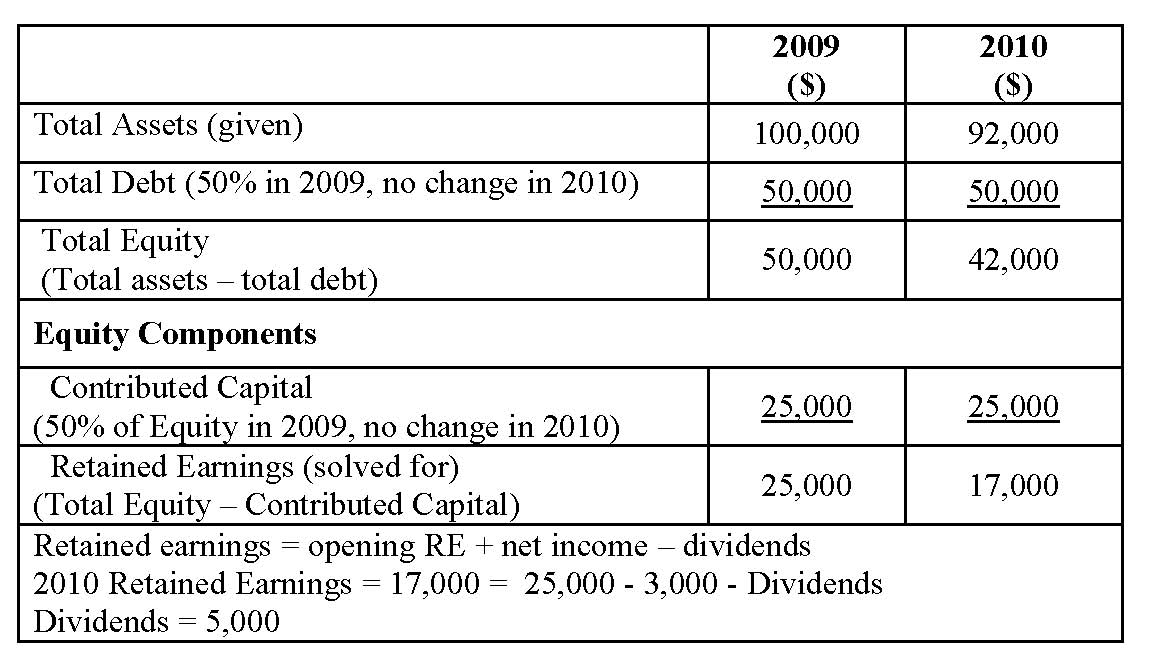

1、The following information is available for a company:

In 2010, the company most likely:【单选题】

A.paid a dividend of $1,000

B.paid a dividend of $5,000

C.did not pay a dividend because they incurred a loss.

正确答案:B

答案解析:“Financial Reporting Mechanics,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Karen O’Connor Rubsam, CFA, R. Elaine Henry, CFA, and Michael A. Broihahn, CFA

2010 Modular Level 1, Vol.3, pp. 43

Study Session: 7-30-b, c

Explain the accounting equation in its basic and expanded forms.

Explain the process of recording business transactions using an accounting system based on the accounting equations.

2、An analyst does research about gross profit margin and gathers the following informationabout a company in 2012 :

● Average inventory is $2 000

● Ending inventory of the year is $2 500

● Total revenue is $20 000

● Inventory turnover ratio is 5.5

● Tax rate is 40%

The gross profit margin for the company is closest to:【单选题】

A.27%

B.31%

C.45%

正确答案:C

答案解析:inventory turnover ratio = cost of goods sold/ average inventory

gross profit = revenue - cost of goods sold

gross profit margin = gross profit/ revenue

所以,边际毛利率的计算如下:($20 000 - 5.5 × $2 000)/$20 000 = 45%。

3、An analyst does research about the impact of tax rate changes on a company's financialstatements.For existing deferred tax assets and liabilities, an increase inincome tax rate:【单选题】

A.increases both deferred tax assets and deferred tax liabilities.

B.decreases both deferred tax assets and deferred tax liabilities.

C.decreases deferred tax assets and increases deferred tax liabilities.

正确答案:A

答案解析:税率的改变对于DTL和DTA的影响:税率的改变不但对当期的income statement有影响,而且对在balance sheet中的DTA和DTL也会有影响。

Tax rate上升,令资产负债表中的DTL上升和DTA上升。

Tax rate下降,令资产负债表中的DTL下降和DTA下降。

4、An analyst does research about real estate investing and gathers the following informationfor a real estate investment:

If the estimate vacancy loss is 5% , the net operating income is closest to:【单选题】

A.$182 500

B.$192 500

C.$200 500

正确答案:C

答案解析:NOI = $250 000 - $250 000 × 5% - $15 000 - $9 000 - $13 000 = $200 500,注意在计算经营性净收入时不考虑折旧和利息费用。

5、At the beginning of the year a company purchased a fixed asset for $500,000 with no expected residual value. The company depreciates similar assets on a straight-line basis over 10 years, while the tax authorities allow declining balance depreciation at the rate of 15% per year. In both cases the company takes a full year’s depreciation in the first year and the tax rate is 40%. Which of the following statements concerning this asset at the end of the year is most accurate?【单选题】

A.The tax base is $500,000.

B.The deferred tax asset is $10,000.

C.The temporary difference is $25,000.

正确答案:C

答案解析:“Long-Lived Assets,” Elaine Henry, CFA and Elizabeth A. Gordon

2011 Modular Level 1, Vol.3, pp.422-425

“Income Taxes,” Elbie Antonites, CFA and Michael A. Broihahn, CFA

2011 Modular Level 1, Vol. 3, pp. 460-466, 470-472

Study Session 9-37-d, 9-38- c, d, f

Calculate depreciation expense given the necessary information.

Determine the tax base of a company’s assets and liabilities.

Calculate income tax expense, income taxes payable, deferred tax assets, and deferred tax liabilities, and calculate and interpret the adjustment to the financial statements related to a change in the income tax rate.

Distinguish between temporary and permanent items in pre-tax financial income and taxable income.

The temporary difference is the difference between the net book value of the asset for accounting purposes [500,000 – (500,000/10)] = $450,000 and the net book value for taxes, [500,000 - 0.15(500,000) = $425,000]. 450,000 – 425,000 = $25,000.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料