下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、All else being equal, an increase in expected yield volatility would most likelycause the price of:【单选题】

A.a callable bond to increase and the price of a putable bond to decrease.

B.a callable bond to decrease and the price of a putable bond to increase.

C.a callable bond to increase and the price of a option-free bond to decrease.

正确答案:B

答案解析:利率波动性增加后,会同时增加债券中内含可赎回权利和可回售权利的价值。

value of a callable bond = value of an option - free bond - value of the call。

value of a putable bond = value of an option - free bond + value of the put。

所以,可赎回债券的价格下降,而可回售债券的价格上升。利率波动性不会影响不含权债券的价格。

2、If a nonfinancial company securitizes its accounts receivables for less than their book value, the most likely effect on the financial statements is to increase:【单选题】

A.net income.

B.cash from operations.

C.cash from financing activities.

正确答案:B

答案解析:“Accounting Shenanigans on the Cash Flow Statement,” Marc A. Siegel

2011 Modular Level I, Vol. 3, pp. 580-581

Study Session 10-41

The candidate should be able to analyze and discuss the following ways to manipulate the cash flow statement:

● stretching out payables,

● financing of payables,

● securitization of receivables, and

● using stock buybacks to offset dilution of earnings.

The securitization of accounts receivables for less than book value would result in a loss on the income statement, but an increase in the cash from operations, reflecting the proceeds received.

3、The following information (U.S. $ millions) for two companies operating in the same industry during the same time period is available:

If both companies achieve a return on equity of 15% for the period, which of the following statements is most likely correct? Compared to Company B, Company A has a:【单选题】

A.higher net profit margin.

B.higher total asset turnover.

C.lower financial leverage multiplier.

正确答案:A

答案解析:“Financial Analysis Techniques”, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, R. Elaine Henry, CFA, and Michael A. Broihahn, CFA

Modular 2010 Level I, Vol. 3 pp.342-344

“Financial Statement Analysis”, Pamela P. Peterson, CFA

2010 Modular Level I, Vol. 4, pp.142-146

Study Session 8-35-d, f, 11-47

Calculate, classify, and interpret activity, liquidity, solvency, profitability, and valuation ratios

4、All else being equal, specifying a lower significance level in a hypothesis test ismost likely to increase the probability of a:【单选题】

A.

B.

C.

正确答案:A

答案解析:显著性水平决定的是犯第一类错误(去真错误)的可能性,降低显著性水平会减少犯第一类错误(去真错误)的可能性,但同时会增加犯第二类错误(去真错误)的可能性。

5、Which of the following statements regarding a commodity index is most accurate?【单选题】

A.Commodity index returns differ from the changes in the prices of their underlying commodities.

B.Commodity indices commonly use an equal weighting method.

C.Commodity indices in the same markets will share similar risk and return profiles.

正确答案:A

答案解析:The performance of commodity indices can be different from their underlying commodities becausethe indices consist of futures contracts on the commodities rather than the actual commodities.Commodity index returns reflect the risk-free interest rate, the changes in future prices, and the rollyield.

CFA Level I

"Security Market Indices," Paul D. Kaplan and Dorothy C. Kelly

Section 7.1

6、An analyst does research about asset-backed securities.Which of the followingstatements is most accurate? A corporation that raises funds through use of anasset-backed security:【单选题】

A.creates a special purpose vehicle that is a subsidiary of the corporation.

B.no longer owns the assets that serve as collateral for the asset-backed security.

C.uses credit enhancement in the reduction in funding cost compared withthe cost of enhancement.

正确答案:C

答案解析:特殊目的机构(SPV)不是公司的附属机构,而是作为担保的独立机构,与公司无关,公司破产并不会影响该机构,所以创设一个SPV能够提高短期融资的信用评级;资产支持证券(ABS)的抵押品仍然属于公司,如果不是创立一个SPV的话;公司会使用信用提升来降低融资成本,与此同时要权衡信用提升的成本。

7、One advantage of the full valuation approach to measuring interest rate risk relative to the

duration/convexity approach is that the full valuation approach:【单选题】

A.increases measurement accuracy.

B.is easier to model than scenario analysis.

C.requires the yield curve to change in a parallel fashion.

正确答案:A

答案解析:“Introduction to the Measurement of Interest Rate Risk”, Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 58, Section 2

Study Session 16-58-a

Distinguish between the full valuation approach (the scenario analysis approach) and theduration/convexity approach for measuring interest rate risk, and explain the advantage of usingthe full valuation approach.

A is correct because the full valuation approach allows modeling of the response to both paralleland non-parallel yield curve changes and will reflect cash flows that change when interest rateschange, whereas the duration/convexity approach assumes parallel yield curve changes andfixed cash flows.

8、An analyst doesresearch about security market indices.Which of the followingstatements is least accurate to explain that a fixed-income market index is moredifficult to create and compute than a stock market index?【单选题】

A.The universe of fixed-income securities is changing constantly.

B.Fixed-income markets are predominantly dealer markets.

C.The number of fixed-income securities is much less than the number ofequity securities.

正确答案:C

答案解析:固定收益指数比股票指数更加难以编制,其中一个原因是债券的种类总处在不断变化中,如是否到期限、是否转换,等等。固定收益指数比股票指数更加难以编制的另一个原因是,固定收益市场主要是交易商市场,无法通过公开市场交易而获得价格信息。另外,固定收益证券的数量要远远超过股票的数量,固定收益证券有不同的发行人、不同的特征以及不同的期限。

9、Which of the following is least likely to be directly reflected in the returns on a commodity index?【单选题】

A.Roll yield

B.Changes in the spot prices of underlying commodities

C.Changes in the futures prices of commodities in the index

正确答案:B

答案解析:“Security Market Indices,” Paul D. Kaplan and Dorothy C. Kelly

2012 Modular Level I, Vol. 5, p. 109–110

Study Session 13-48-j

Discuss indices representing alternative investments.

B is correct. Commodity index returns reflect the changes in future prices and the roll yield. Changes in the underlying commodity spot prices are not reflected in a commodity index.

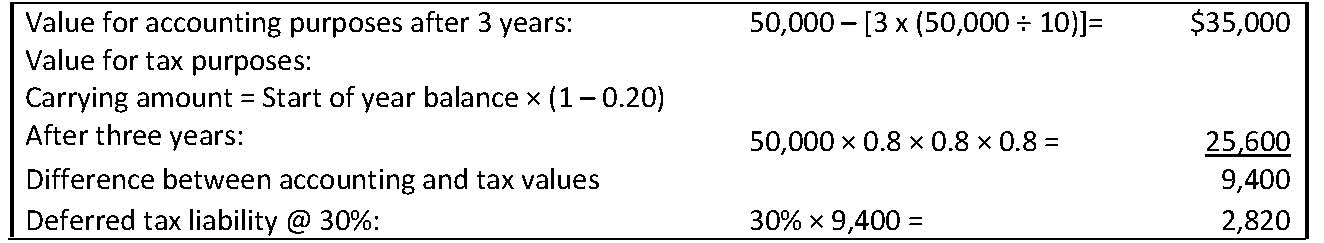

10、A company purchased equipment for $50,000 on 1 January 2009. It is depreciating the equipment over a period of 10 years on a straight-line basis for accounting purposes, but for tax purposes, it is using the declining balance method at a rate of 20%. Given a tax rate of 30%, the deferred tax liability as at the end of 2011 is closest to:【单选题】

A.$420.

B.$2,820.

C.$6,720.

正确答案:B

答案解析:“Income Taxes,” Elbie Antonites and Michael A. Broihahn

2012 Modular Level I, Vol. 3, pp. 493–495

Study Session: 9-31-c, d

Determine the tax base of a company’s assets and liabilities.

Calculate income tax expense, income taxes payable, deferred tax assets, and deferred tax liabilities, and calculate and interpret the adjustment to the financial statements related to a change in the income tax rate.

B is correct. The deferred tax liability is equal to the tax rate times the difference between the carrying amount of the asset and the tax base.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料