下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Fixed Income Investments5道练习题,附答案解析,供您备考练习。

1、An analyst does research about various risks of investing in bonds.Investors inU.S.Treasury Inflation-Protected Securities are most likely to be exposed to:【单选题】

A.credit risk.

B.reinvestment rate risk.

C.purchasing power risk.

正确答案:B

答案解析:美国政府的通货膨胀保护证券信用极好,所以没有违约风险。同时,由于通货膨胀保护证券的本金会随着通货膨胀率调整,所以大幅度减少了购买力风险。但通货膨胀保护证券所拿到的利息会面临再投资风险。

1、Duration is most accurate as a measure of interest rate risk for a bond portfolio when the slope ofthe yield curve:【单选题】

A.stays the same.

B.increases.

C.decreases.

正确答案:A

答案解析:Duration measures the change in the price of a portfolio of bonds if the yields for all maturities changeby the same amount; that is, it assumes the slope of the yield curve stays the same.

CFA Level 1

"Understanding Fixed-Income Risk and Return," James F. Adams and Donald J. Smith

Section 3

1、All else being equal, in a rising interest rate environment, the price of a floating-ratesecurity will most likely decline if:【单选题】

A.there is no cap.

B.the margin required by investors declines.

C.the coupon is reset every six months rather than monthly.

正确答案:C

答案解析:如果没有利率顶(CAP)就会降低利率风险,利率上升,息票率也随之上升,价格不会下跌。如果投资者要求的收益差(margin)减少,会提高浮动利率债券的价格,而不是降低。息票每6个月设定一次而不是每个月设定一次,在利率上升的情况下,浮动利率证券无法反映最新的市场利率,会造成其价格下跌。

1、DMT Corp. issued a five-year floating-rate note (FRN) that pays a quarterly coupon of three-month LIBOR plus 125 bps. The FRN is priced at 96 per 100 of par value. Assuming a 30/360 day-count convention, evenly spaced periods, and constant three-month LIBOR of 5%, the discount margin for the FRN is closest to:【单选题】

A.221 bps.

B.180 bps.

C.400 bps.

正确答案:A

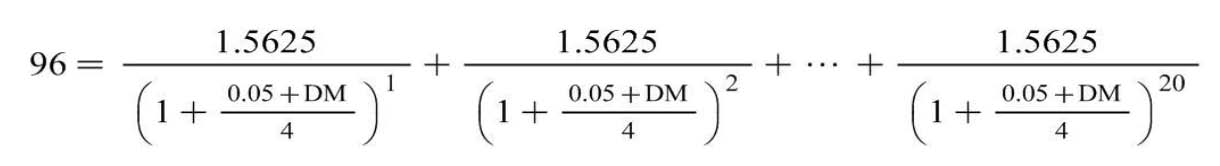

答案解析:The interest payment each period per 100 of par value is:

The discount margin can be estimated by solving for DM in the equation:

The solution for the discount rate, r = (0.05+DM)/4 is 1.8025%. Therefore DM = 2.21%, or 221 bps.

2014 CFA Level I

“Introduction to Fixed-Income Valuation,” by James F. Adams and Donald J. Smith

Section 3.4

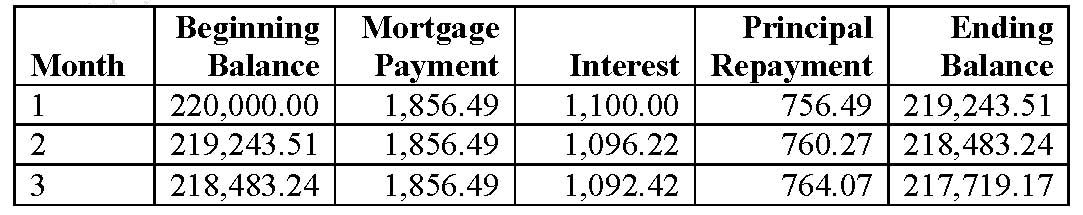

1、A level payment, fixed-rate, fully amortizing mortgage loan for $220,000 is obtained with a term of 15 years, a mortgage rate of 6.0% with monthly compounding, and a monthly payment of $1,856.49. Assuming that the borrower does not prepay or default, the principal that is repaid during the first 3 months is closest to:【单选题】

A.$660.

B.$2,281.

C.$3,667.

正确答案:B

答案解析:“Overview of Bond Sectors and Instruments,” Frank J. Fabozzi, CFA

2011 Modular Level I, Vol. 5, pp. 401-404

Study Session 15-63-e

Describe the types and characteristics of mortgage-backed securities and explain the cash flow, prepayments, and prepayment risk for each type.

B is correct according to the table below showing the remaining principal balance after 3 monthly payments.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料