下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Fixed Income Investments5道练习题,附答案解析,供您备考练习。

1、Which type of bond is most likely to be preferred by investors in a falling interest rate environment?【单选题】

A.A floating-rate note with no cap or floor

B.A capped floating-rate note

C.A floored floating-rate note

正确答案:C

答案解析:A floored floating-rate note prevents the coupon rate from falling below the specified minimum rate. In a falling interest rate environment, this feature will benefit investors because it guarantees that the coupon rate will not fall below the specified minimum rate.

2014 CFA Level I

"Fixed-Income Securities: Defining Elements," by Moorad Choudhry and Stephen E. Wilcox

Section 4.2

1、Consider two bonds that are identical except for their coupon rates. The bond that will have the highest interest rate risk most likely has the:【单选题】

A.lowest coupon rate.

B.highest coupon rate.

C.coupon rate closest to its market yield.

正确答案:A

答案解析:“Risks Associated with Investing in Bonds,” Frank J. Fabozzi

2012 Modular Level I, Vol. 5, p. 354

Study Session 15-54-c

Explain how a bond maturity, coupon, embedded options, and yield level affect its interest rate risk.

A is correct because a lower coupon rate means that more of the bond’s value comes from repayment of face value, which occurs at the end of the bond’s life.

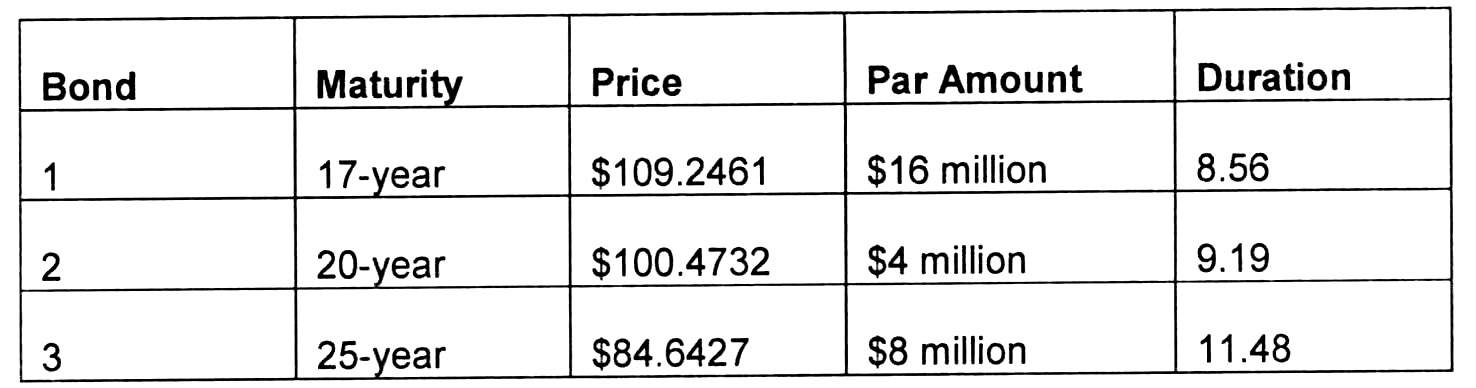

1、The following table provides information about a portfolio of three bonds.

Based on this information, the duration of the portfolio is closest to:【单选题】

A.9.74.

B.9.48.

C.9.35.

正确答案:C

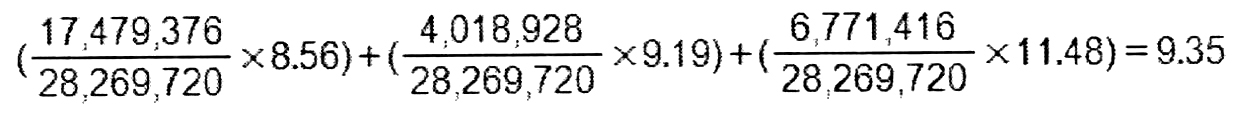

答案解析:The market values of the bonds (Price × Par amount) are $17,479,376, $4,018,928, and $6,771,416,respectively, for a portfolio value of $28,269,720. Therefore, the duration of the portfolio is

CFA Level I

"Understanding Fixed-Income Risk and Return," James F. Adams and Donald J. Smith

Section 3.4

1、An analyst does research about the various types of debt issued by corporations.A debt vehicle created to facilitate commercial trade transaction is mostlikely a(n):【单选题】

A.issued bond.

B.medium-term note.

C.bankers acceptance.

正确答案:C

答案解析:保险过的债券(issued bond)是一种特殊的地方政府债券,该债券除了由发行人的收入担保外,还由商业保险公司通过保险条款承保。中期票据(medium-term note)的特点是,具有灵活的发行机制,代理人可以多次发行期限不同的债券给投资者,来满足公司的融资需求。银行承兑汇票(bankers acceptance)主要是用来满足商品交易的支付工具。

1、Which of the following embedded options most likely provides a right to the issuer?【单选题】

A.Call feature

B.Conversion provision

C.Put feature

正确答案:A

答案解析:The right to call the issue is beneficial to the issuer when interest rates fall.

2014 CFA Level I

"Fixed-Income Markets: Issuance, Trading, and Funding," by Moorad Choudhry, Steve V. Mann, and Lavone F. Whitmer

Section 6.3.5

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料