下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、Noor Hussein, CFA, runs a financial advisory business, specializing in retirement planning and investments. One of her clients asks her to advise the firm’s pension fund trustees on available investments in the market including Islamic products. On the day prior to the meeting, Hussein spends an hour familiarizing herself with Islamic investment products and getting updates on local market conditions. The next day she recommends Islamic investment products to the trustees based on her research and her expertise in retirement planning and investments. The trustees subsequently incorporate Islamic products into their investment allocation. Did Hussein’s basis for the recommendation most likely comply with the CFA Code of Ethics?【单选题】

A.Yes.

B.No, with regard to Misconduct.

C.No, with regard to Diligence and Reasonable Basis.

正确答案:C

答案解析:“Code of Ethics and Standards of Professional Conduct,” CFA Institute

2011 Modular Level I, Vol. 1, pp. 107-111

Study Session 1-2-b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

C is correct because Hussein did not likely act with competence and diligence as required by the CFA Institute Code of Ethics [standard v(a)]. An hour of preparation with regard to Islamic investment products would not likely be considered sufficient to give investment advice to pension plan trustees.

2、Which of the following is the most likely reason for an analyst to choose the direct method rather than the indirect method for analyzing a firm’s operating cash flows?【单选题】

A.To avoid making adjustments for non-cash items

B.To identify operating cash flows by source and by use

C.To understand the relationship between net income and operating cash flows

正确答案:B

答案解析:“Understanding Cash Flow Statements,” Elaine Henry, CFA, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, and Michael A. Broihahn, CFA

2013 Modular Level I, Vol. 3, Reading 27, Section 2.3, 2.3.1, 2.3.2

Study Session 8-27-d

Distinguish between the direct and indirect methods of presenting cash from operating activities and describe the arguments in favor of each method.

B is correct. The direct method cash flow statement presents specific operating cash flows by source and use.

3、Chan Liu, CFA, is the new research manager at the Pacific MicroCap Fund. Liu observed thefollowing activities after she published a research report on a thinly traded micro-cap stock thatincluded a "buy" recommendation:

·Pacific traders purchased the stock for Pacific's proprietary account and then purchased the samestock for all client accounts; and

·Pacific marketing department employees disseminated positive, but false, information about thestock in widely read internet forums.

Liu notes the stock's price increased more than 50% within a period of two days and was then soldfor Pacific's account. Which of the following steps is most appropriate for Liu to take to avoidviolating the CFA Institute Standards of Professional Conduct?【单选题】

A.Remove her name from the micro-cap stock research report.

B.Publicly refute the false information posted on internet forums.

C.Report the observed activities to her employer.

正确答案:C

答案解析:Certain staff at Liu's employer appear to be engaged in front running, a violation of Standard VI(B)-Priorityof Transactions, and market manipulation, a violation of Standard II(B)-Market Manipulation.If Liu observes these violations without taking steps to notify her employer, she will be in violation ofStandard I(A)-Knowledge of the Law. Liu should know that the conduct observed is likely a violationof applicable laws, rules, and regulations as well as a violation of the CFA Institute Standards ofProfessional Conduct. Her first step, therefore, should be to attempt to stop the behavior by bringing itto the attention of the employer through a supervisor or the firm's compliance department. Inactionmay be construed as participation or assistance in the illegal or unethical conduct.

CFA Level I

"Guidance for Standards I-VII"

Standard I (A)-Knowledge of the Law, Standard II(B)-Market Manipulation, Standard VI(B)-Priority ofTransactions

4、During 2010, Company A sold a piece of land with a cost of $6 million to Company B for $10 million. Company B made a $2 million down payment with the remaining balance to be paid over the next 5 years. It has been determined that there is significant doubt about the ability and commitment of the buyer to complete all payments. Company A would most likely report a profit in 2010 of:【单选题】

A.$4 million using the accrual method.

B.$0.8 million using the installment method.

C.$2 million using the cost recovery method.

正确答案:B

答案解析:"Understanding The Income Statement,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2011 Modular Level I, Vol.3, pp.150-152

Study Session: 8-32-b

Explain the general principles of revenue recognition and accrual accounting, demonstrate specific revenue recognition applications (including accounting for long-term contracts, installment sales, barter transactions, and gross and net reporting of revenue), and discuss the implications of revenue recognition principles for financial analysis.

Under the installment method, the portion of the total profit that is recognized in each period is determined by the percentage of the total sales price for which the seller has received cash. For Company A 2/10 x 4 = $0.8 million. Note, cost recovery method could be used in this case, but the reported profit would be $0.

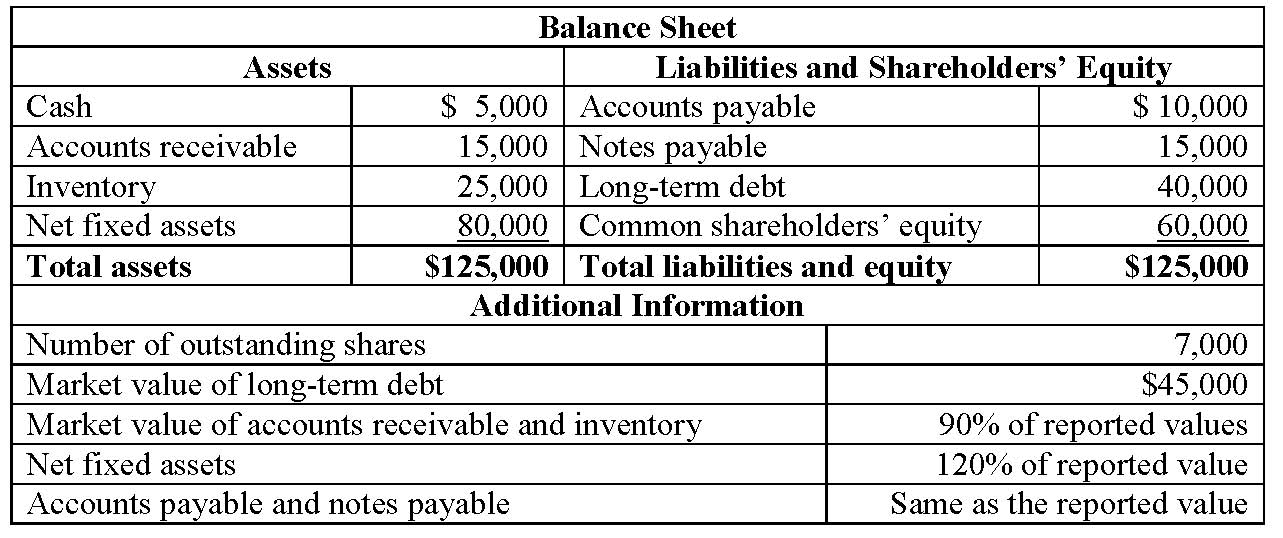

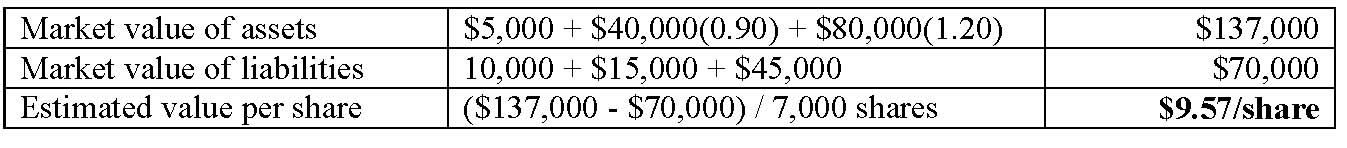

5、An analyst gathers the following information about a company:

Using asset-based valuation approach, the estimated value per share is closest to:【单选题】

A.$ 9.57.

B.$10.29.

C.$11.00.

正确答案:A

答案解析:“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA, and Stephen E. Wilcox, CFA

2011 Modular Level I, Vol. 5, pp. 300-303

Study Session 14-60-j

Explain asset-based valuation models and demonstrate the use of asset-based models to calculate equity value.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料