下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Derivative Investments5道练习题,附答案解析,供您备考练习。

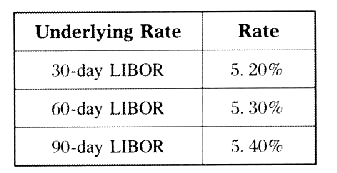

1、An investor does research about forward rate agreement and takes a $1 millionshort position in a forward rate agreement 3 × 9 quoted at 5% according to LIBOR.At expiration, the investor gathers the following rates:

The payoff for this investor is closest to:【单选题】

A.$495.62

B.$500.00

C.$660.83

正确答案:A

答案解析:FRA 3 × 9说明该远期利率协议是3个月的期限,针对6个月的LIBOR,所以取5.3%作为到期结算的LIBOR。

[1 000 000 × (5.30% - 5%) × 60/360]/(1 + 5.30% × 60/360) = 500/1.00883 = 495.62。

1、An analyst does research about forward products.Which of the following statementsis the most effective way to terminate a forward contract prior to expiration?【单选题】

A.One party of the forward contract closes the position with a local exchange.

B.One party of the forward contract closes the position with the same counterparty.

C.One party of the forward contract closes the position with the other counterpartywith AAA credit rating.

正确答案:B

答案解析:远期合约提前终止不会与交易所,因为远期合约都在场外交易,最有效的是原来对手方签定反向头寸的协议以终止,此时没有额外的信用风险,如果与其他第三方签定反向头寸的协议会增加信用风险。

1、An investor purchases ABC stock at $71 per share and executes a protective put strategy. The putoption used in the strategy has a strike price of $66, expires in two months, and is purchased for$1.45. At expiration, the protective put strategy breaks even when the price of ABC is closest to:【单选题】

A.$64.55.

B.$67.45.

C.$72.45.

正确答案:C

答案解析:To break even, the underlying stock must be at least as high as the amount expended up front toestablish the position. To establish the protective put, the investor would have spent $71+$1.45=$72.45.

CFA Level I

"Risk Management Applications of Option Strategies," Don M. Chance

Section 2.2.2

1、An analyst does research about impact to option due to interest rate and volatilityof the underlying.Which of the following statements best describes the effect ofthe level of interest rates and volatility of the underlying on the price of options?All else being equal, prices for:【单选题】

A.put options are positively related to the level of interest rates.

B.call options are positively related to the level of interest rates.

C.put options are negatively related to the volatility of the underlying.

正确答案:B

答案解析:当利率越高时,更多的人会选择投资看涨期权,因为可以延后购买资产的时间,即现在只要付一部分期权费就可以买入将来购买这项资产的权利,所以看涨期权与利率正相关。相反地,当利率越高时,更多的人会选择卖出看跌期权,导致看跌期权价格下跌,所以看跌期权与利率负相关。资产的波动性与看涨期权及看跌期权的价格都是正相关。

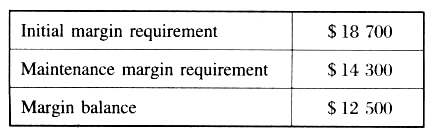

1、An analyst does research about future contracts.A commodity futures accounthas the following margin balances:

The variation margin is closest to:【单选题】

A.$1 800

B.$4 400

C.$6 200

正确答案:C

答案解析:$18 700 - $12 500 = $6 200,当保证金余额低于维持保证金时,要增加保证金到初始保证金的额度,增加的部分被称为变动保证金。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料