下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、If the quantity demanded of pears falls by 4% when the price of apples decreases by 3%, then apples and pears are best described as:【单选题】

A.substitutes.

B.complements.

C.inferior goods.

正确答案:A

答案解析:“Elasticity,” Michael Parkin

2011 Modular Level I, Vol. 2, pp. 19, 21

Study Session 4-13-a

Calculate and interpret the elasticities of demand (price elasticity, cross elasticity, and income elasticity) and the elasticity of supply and discuss the factors that influence each measure.

The cross elasticity of demand is defined as the percentage change in quantity demanded divided by the percentage change in the price of a substitute or complement. If the cross elasticity of demand is positive, the goods are substitutes. In this case, the 4 % decline in quantity of pears is divided by the 3 % decline in the price of apples, which is a positive number, -4 / -3 = +1.333333.

2、Which of the following is closest to the value of a 10-year, 6% coupon, $100 par value bond with semi-annual payments assuming an annual discount rate of 7%?【单选题】

A.$92.89

B.$99.07

C.$107.44

正确答案:A

答案解析:“Introduction to the Valuation of Debt Securities,” Frank J. Fabozzi

2012 Modular Level I, Vol. 5, pp. 496–498

Study Session 16-57-c

Calculate the value of a bond (coupon and zero coupon).

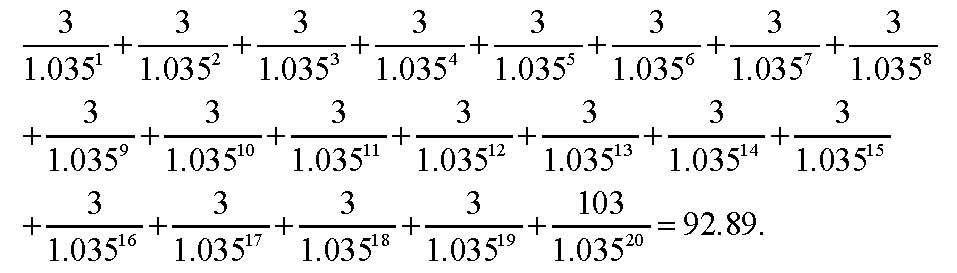

A is correct because a security with 19 semi-annual payments of $3 interest and a 20th payment of $103 (interest plus return of face value) with a semi-annual discount rate of 3.5% is $92.89 or

3、An analyst does research about intangible assets.Expenditures on research aremost appropriately:【单选题】

A.expensed in the year incurred.

B.capitalized as intangible assets and amortized over the life of the asset.

C.capitalized as intangible assets and tested annually for impairment of value.

正确答案:A

答案解析:IFRS要求用于研究的支出(或在一个内部项目的研究阶段的支出)应该费用化而不是资本化。研究成本(research cost)是指发现新的科学技术知识,并加以理解的过程中发生的成本。然而,开发成本(development cost)是资本化。开发成本是指将研究发现转化为一个新产品或新工艺流程的计划或设计的过程中发生的成本。在U.S.GAAP下,研究和开发成本一般都费用化,唯一例外的是软件开发成本(software developmentcost)。

4、A security market in which all the bids and asks for a stock are gathered to arrive at a single price that satisfies most of the orders is best described as a:【单选题】

A.call market.

B.dealer market.

C.primary market.

正确答案:A

答案解析:“Organization and Functioning of Securities Markets,” Frank K. Reilly, CFA and Keith C. Brown, CFA

2010 Modular Level I, Vol. 5, pp. 13-15

Study Session 13-52-c

Distinguish between call and continuous markets.

A call market is a market in which all the bids and asks for a stock are gathered to arrive at a single price where the quantity demanded is as close as possible to the quantity supplied.

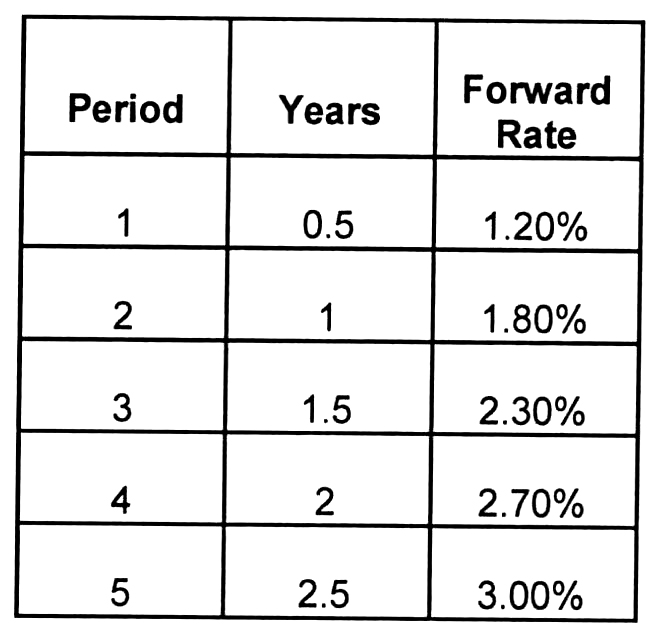

5、Using the following US Treasury forward rates, the value of a  -year $100 par value Treasury bondwith a 5% coupon rate is closest to:

-year $100 par value Treasury bondwith a 5% coupon rate is closest to: 【单选题】

【单选题】

A.$101.52.

B.$104.87.

C.$106.83.

正确答案:C

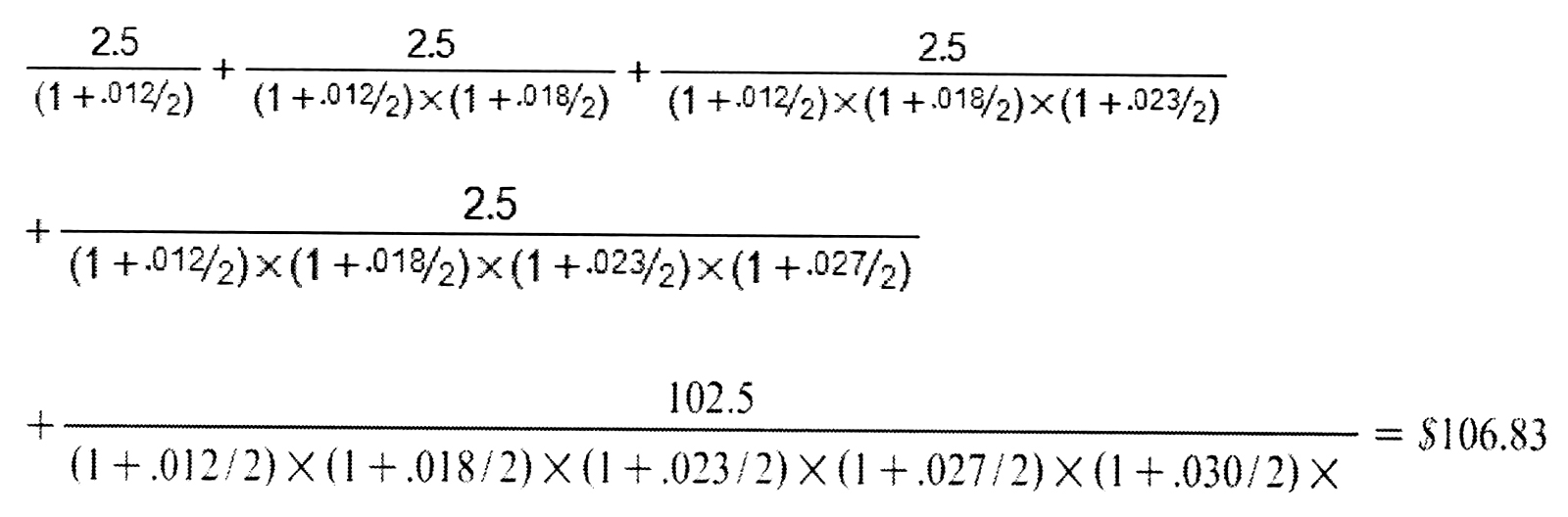

答案解析:The value of the bond is

CFA Level I

"Introduction to Fixed-Income Valuation," James F. Adams and Donald J. Smith

Section 4

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料